Captive Insurance: Taming Risk for Business Success

When it comes to protecting their businesses, entrepreneurs understand the importance of comprehensive insurance coverage. However, traditional insurance policies may not always provide the tailored solutions needed to address specific risks faced by a company. This is where captive insurance steps in, offering a unique alternative that allows businesses the ability to take control of their own risk management. In this article, we dive into the world of captive insurance, exploring how it harnesses the power of the IRS 831(b) tax code to provide businesses with greater flexibility and potential financial benefits. So, let’s untangle the concept of captive insurance and discover how it can be a game-changer in the ever-evolving landscape of risk management.

At its core, captive insurance enables businesses to form their own insurance company, known as a microcaptive, to cover the risks that traditional insurers may deem as too specific or costly. By establishing a captive, companies gain the advantage of customizing their insurance solutions to fit their unique needs, ensuring a more tailored approach to managing risk. Furthermore, this alternative form of insurance can provide not only improved coverage but also potential tax advantages, particularly through the IRS 831(b) tax code.

So, if you’re intrigued to learn more about how captive insurance can empower businesses to take control of their risk management strategies while capitalizing on potential financial benefits, join us on this exploration of captive insurance and its role in taming risk for business success.

Understanding Captive Insurance

Captive insurance is a unique risk management strategy that can benefit businesses in various industries. It involves the creation of an insurance company to provide coverage for the risks faced by its parent company or group of related companies. This self-insurance approach allows businesses to have more control over their insurance costs and tailor coverage to their specific needs.

One important aspect of captive insurance is the 831(b) tax code, which provides certain tax advantages for small insurance companies. Under this code, captives with an annual premium income of $2.3 million or less can elect to be taxed only on their investment income, rather than their entire premium income. This tax benefit has attracted many businesses to explore the possibilities of setting up their own captive insurance companies.

It’s worth noting that captive insurance goes beyond just tax advantages. By establishing a captive, businesses can access coverage for risks that may be difficult or expensive to insure in the traditional market. This is especially true for businesses with unique or specialized risks, such as those in niche industries or with high-frequency, low-severity risks. Captives provide an opportunity to design and customize insurance policies that specifically address these risks, providing a level of protection that aligns with the parent company’s needs.

Overall, captive insurance offers businesses a way to better manage their risks while potentially enjoying tax benefits. It allows for increased control, flexibility, and tailored coverage options, making it a valuable strategy for those looking to enhance their risk management practices and contribute to their long-term success.

The Benefits of Utilizing IRS 831(b) Tax Code

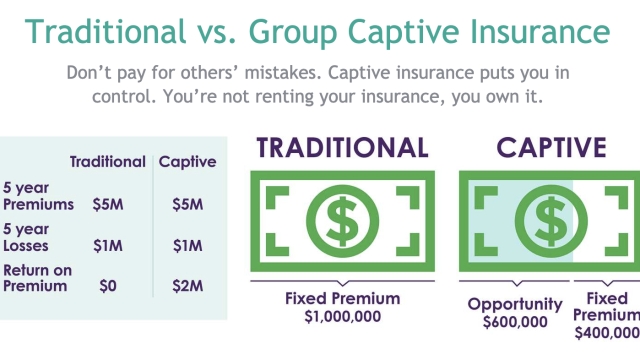

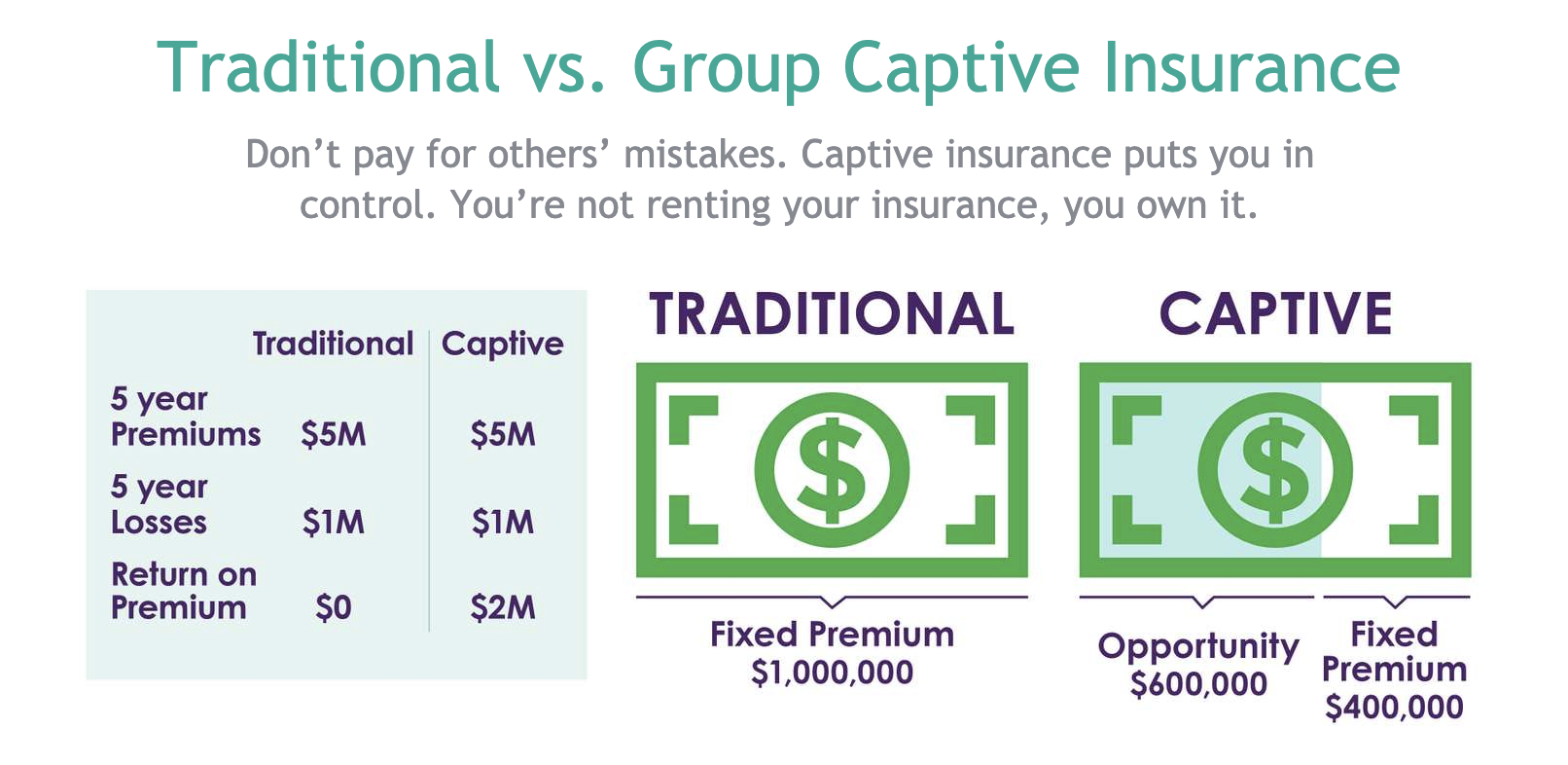

Captives insurance, specifically those under the IRS 831(b) tax code, offer several benefits for businesses looking to effectively manage their risks. One significant advantage is the potential for substantial cost savings. By establishing a captive insurance company, businesses can retain a portion of their insurance premiums that would otherwise be paid to traditional insurance providers. This allows for greater control over the funds and potential investment opportunities.

Another benefit is the flexibility that captive insurance provides. Under the IRS 831(b) tax code, captives can insure a wide range of risks specific to the business’s industry or operations. This means that tailored coverage can be obtained, addressing risks that traditional insurance policies may not cover adequately. Furthermore, captives can adapt and evolve with the changing needs of the business, ensuring continued protection over time.

Additionally, captives insurance can enhance risk management strategies. With a captive in place, businesses have the ability to access more detailed and accurate data regarding their risks. This valuable information allows for better risk assessment, enabling businesses to implement targeted risk mitigation measures. By actively managing and reducing risks, companies can create a more secure foundation for long-term success.

In summary, the utilization of the IRS 831(b) tax code for captive insurance can bring significant advantages to businesses. These benefits include cost savings, flexibility in coverage options, and improved risk management capabilities. By taking advantage of captive insurance, businesses can better control their risks and ultimately enhance their overall financial performance.

Exploring Microcaptives and Their Potential Impact

831b

In recent years, the concept of captive insurance has gained significant attention in the business world. One specific type of captive insurance, known as microcaptives, has emerged as an intriguing option for many organizations. Microcaptives operate under the IRS 831(b) tax code, which provides certain tax advantages to smaller insurance companies.

Microcaptives, as the name suggests, are smaller captive insurance companies that cater to the needs of a specific business or industry. They allow businesses to retain more control over their insurance policies and potentially save on premiums. By forming a microcaptive, companies can effectively manage their risks while enjoying potential tax benefits.

Under the IRS 831(b) tax code, microcaptives can elect to be taxed only on their investment income rather than their premiums. This arrangement can create significant tax savings for qualifying companies. However, it is crucial to note that the IRS has established specific guidelines and requirements for companies seeking to benefit from the 831(b) tax code.

While microcaptives offer enticing benefits, it’s important for businesses to carefully consider their suitability and consult with experts in captive insurance before establishing one. Understanding the potential impact of microcaptives is crucial for businesses seeking to leverage this innovative insurance solution to manage risk effectively.